GST Login, Registration, Payment & Status Check

Goods and Services Tax (GST) is a tax added to most goods and services we buy or use within a country. When we purchase something, we pay this tax, which is collected by the seller and remitted to the government. GST prevents double taxation by allowing businesses to recover the tax already paid at each step in the supply chain. This means businesses can recover the GST they have paid on their purchases, which simplifies their operations.

GST Login & Status

| Aspects | Simple Detail |

|---|---|

| What is it | Tax on buying and selling goods and services. |

| Where it is used | India |

| When it started | July 1, 2017 |

| Who pays it | Mostly businesses, but it affects the price you pay for things. |

| Why its there | To make taxes simpler and create one big market. |

| Important part | Businesses need to register and file returns. |

| Key Idea | Businesses can often get credit for the tax they’ve already paid on their purchases. |

| For moving goods | If you’re moving goods worth over a certain amount, you need an e-way bill. |

| Small businesses | There’s a simpler way for small businesses to pay tax. |

| Things Change | The tax rules and rates can be updated. |

| Good have code | Goods have special codes (HSN) to know the tax rate. |

| How it works | Different tax rates (like 0%, 5%, 12%, 18%, 28%) depending on the item. |

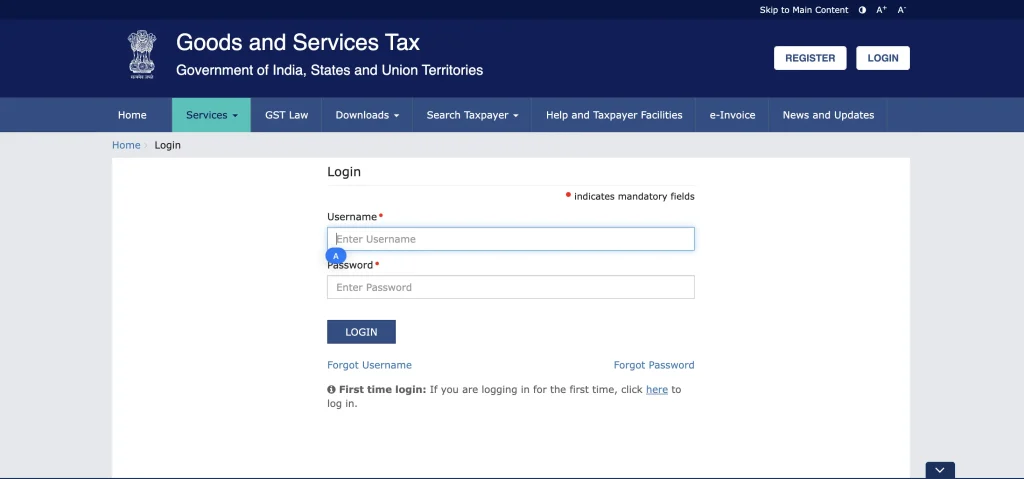

GST Login Process

To get access to GST login, you have to follow these steps;

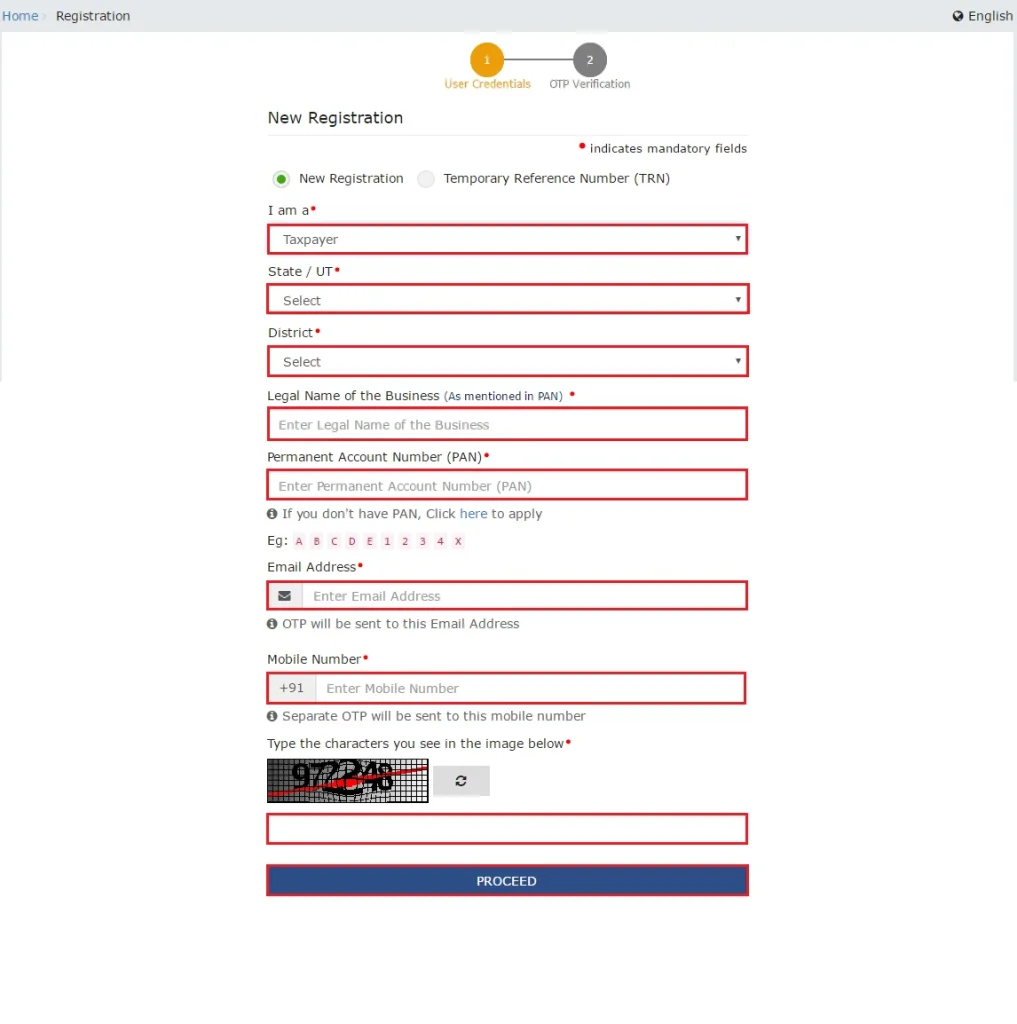

GST Registration Process

If we operate a business and are required to collect tax from our customers, we need to register for GST. GST registration is available online through the official site www.gst.gov.in. We complete a form called REG-01 which consists of 17 steps. We need to provide some basic business information, upload some documents, and verify our mobile and email through OTP (one-time password) as authentication.

After submitting the form, a GST officer will review our application. If everything checks out, we will receive a GST certificate and our GSTIN (GST Identification Number), which will be our unique tax number. The GSTIN is required for filing returns, paying taxes, and operating a business legally.

Documents Needed for GST Registration

When applying for GST, we must submit the appropriate documents that prove our identity and the legitimacy of our business. The following documents will be required:

These documents help to ensure the validity and transparency of your business.

GST Registration Fees

The good news is that registering for a GST number is FREE of charge when you do it yourself on the GST official website. No government fee is required for self-registration.. This is great news for small business owners who would like to register for GST themselves to save costs.

If we do not know how to do it or find this whole process complicated, we could also hire someone to help us. We could hire a GST expert (like a Chartered Accountant, CA) or hire a GST practitioner.These experts may charge a fee, which depends on the scope of work.

Their fee would depend on how much work they have to do. So, if we are comfortable using the internet and are confident that we know what documents are needed to register for GST, we can register for GST ourself and not pay a single cent.

GST Payment

Once registered for GST, we are required to make periodic payments and submit GST returns on time. Timely GST payments and return filings help avoid penalties.

Types of GST

GST is classified according to the point of sale.

- CGST: Collected by the central government for intra-state sales.

- SGST: Collected by the state government for intra-state sales.

- IGST: Applied to inter-state sales.

- UTGST: Applied to sales in union territories.

Payment Due Dates and Deadlines

GST is payable on either a monthly or quarterly basis, based on our filing period. For most monthly filers, the due date for payment is the 20th of each month. Payments should be made before the due date to avoid penalties.

Online Payments via GST Portal

To pay GST online, users have to follow these steps;

- Log in to the official GST website.

- Go to the Services menu, select Payments, then click Create Challan.

- Fill in the required fields, such as GST number, tax period, and amount.

- Choose a payment option (Net Banking, NEFT/RTGS, Credit Card, or Debit Card).

- Generate the challan and proceed with payment.

Checking GST Status

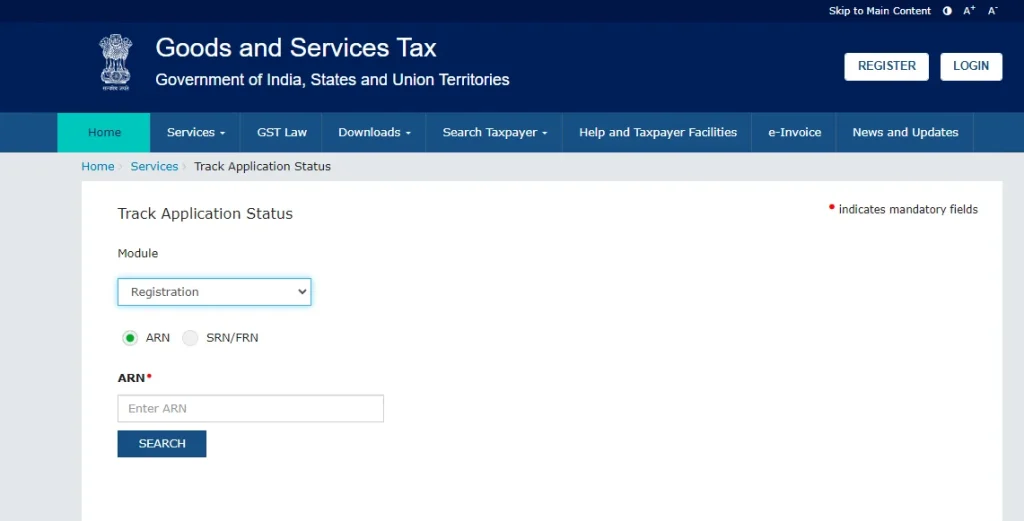

Once we apply for GST registration, we will receive an ARN (Application Reference Number). We can use this ARN to check the status of our application on the GST portal. This will let us know if our registration has been approved, is pending, or needs further information.

Check Return Filing Status

If we have filed GST returns, we can check our return files via the following steps:

- Log in to the GST Portal.

- Navigate to Services > Returns > Track Return Status.

- Select the return period (month/year).

We will see whether our return is filed, pending, or has issues requiring attention.

Check GST Payment Status

When we have made a GST payment, the steps below will tell us whether it has been successful or not:

- Navigate to Services > Payments > Track Payment Status.

- Enter CPIN (Challan Payment Identification Number).

- This page will tell us if the payment has been successful, pending, or has failed.

How to use ARN for Tracking

- The ARN is a useful tracking tool. We can use it to track the status:

- Registration application,

- refund request,

- or any request for changes (amendment).

To do this:

- Navigate to Track Application Status on the GST Portal.

- Enter ARN.

- We will see real-time updates of our request.

GST Error

A GST error is a mistake in working out the correct amounts of GST when completing a tax form (called an activity statement). Errors of this kind often occur with the amounts of GST we have to pay, GST credits we are claiming back, or modified amounts to be adjusted in our business’s GST credits or GST on sales. A GST mistake does not cover an error in the total price of a sale or a purchase.

Types of GST errors and their implications

GST errors can lead to issues for businesses struggling with finances. Errors tend to take one of two forms; These errors add unnecessary complexity to business operations. Understanding credit and debit errors can eliminate error types in the reporting or claiming process, which is important for all businesses in maintaining accuracy with the rules of GST. As stated earlier, there are two types of GST errors:

Credit Error: Credit errors occur when a business pays too much GST on a purchase. This could happen in many ways, for example, if the business reports the same sale on more than one occasion, or fails to claim all GST credits for purchases. What results is a tax overpayment. It is important to be aware of credit errors so that businesses do not end up paying more tax than necessary on their behalf.

Debit Error: Debit errors occur when a business pays too little GST. This could happen if the business forgets to include GST on a sale transaction or claims more GST credits than allowed. Either way, it has the same result of being out of compliance and causing a penalty or infraction.Identifying and correcting debit errors is essential for business compliance and financial health to remain compliant and police fines for reporting claims.

Understanding GST errors and fixing them allows businesses to arrive at a GST reportable event with the right information needed to stay accurate and to keep the business financially healthy.

Tips for Using the GST Portal Effectively

The GST portal is a useful online platform for various taxpayer functions, including GST registration, payment of taxes ,filing returns, checking application status, etc. To navigate through the portal successfully, there are simple rules to follow. First, always visit the official site: www.gst.gov.in. Never click on links from unverified email addresses or messages. We never know if they are fake. Don’t forget to keep the login credentials protected. Never share your username or password with anyone, and make a habit of changing password on a timely basis.

We should use the GST site on up-to-date web browsers like Google Chrome or Mozilla Firefox because outdated versions sometimes do not support the functions on the site. We may want to bookmark useful pages like return filing, challan payment, or application status pages to improve efficiency when returning to the GST site in the future. Avoid trying to file or make payments on the last date. The site may experience heavy traffic and delays.

Before doing any work on the portal, like registering or filing a return, ensure that our documents are prepared and in the proper format (PDF, JPG, etc.). It is also a good habit to regularly open our dashboard and keep tabs on our notifications; we may have messages with either deadlines or updates.

Ensure that your email and phone number are up to date so we receive all alerts, OTPs, and government messages. If we want to get quick access to GST services on our mobile phone, we can also use the GST mobile app. After doing those simple actions, we can utilize the GST portal seamlessly and perform our tax work with safety and within the statutory timelines.

Conclusion

Goods and Services Tax (GST) has significantly transformed India’s tax system by eliminating many indirect taxes, including Value Added Tax (VAT), service tax, and excise duty, replacing them with one self-contained, holistic levy. GST has enabled easier taxation and has become more uniform across states. GST aims to simplify the old tax system and has also reduced the level of bureaucracy, making it easier to do business.